Lowers 2012 Outlook on Weaker Near-Term Environment for its Roofing and Composites Businesses

Owens Corning (NYSE: OC) today lowered its 2012 earnings outlook, reflecting a weaker environment for its Roofing and Composites businesses. Full-year adjusted earnings before interest and taxes (EBIT) for the company are now expected to be in the range of 280 million USD to 310 million USD with the primary uncertainty through the remainder of the year attributed to roofing volumes.

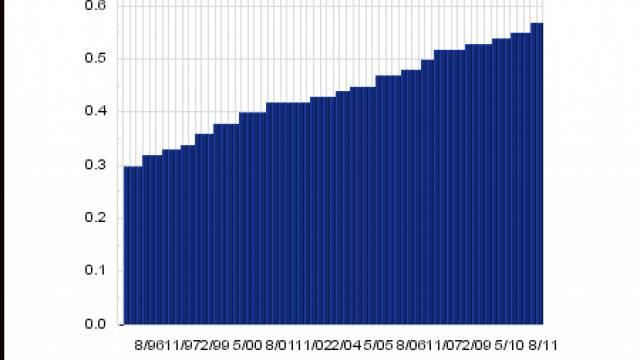

The company previously disclosed late second-quarter weakness in the U.S. roofing shingle market, which persisted early into the third quarter. While there was some improvement through most of the third quarter, shipments weakened following a mid-September price increase and are not expected to improve for the remainder of year. As a result, the company has lowered its Roofing revenue outlook for the full-year, now estimated to be approximately 2 billion USD. Pricing improved sequentially in the third quarter on slightly higher asphalt costs. While fixed cost controls continue to be effective, the significant revenue decline in the second half of 2012 will result in margin compression. Despite the market weakness of the second half, the market outlook and competitive environment supports reaffirmation of the company’s mid-term guidance of mid-teen or better EBIT margins.

Second-half 2012 Composites demand will be impacted by lower global industrial production, particularly in Europe, as well as by the weaker U.S. roofing market. The company’s estimate for global glass fiber market demand growth in 2012 has been reduced to approximately 3%, compared to the long-term historical average growth rate of 5%. To respond to this weaker environment, the company has initiated further production curtailments to bring inventories in line with previously discussed year-end targets.

The transformation of the Composites manufacturing network to a low-delivered-cost asset base remains on track; however, start-up costs for its Mexico expansion and certain other manufacturing costs exceeded the company’s expectations for the third quarter. The effects of the slower demand, costs associated with the manufacturing network transformation, and the impact of further curtailments to reach inventory goals have led to lower margin expectations for the business for the second half of the year.

The global macro-environment outlook now places the attainment of double-digit margins at risk for 2013. However, the company expects the actions to optimize its global Composites manufacturing network to yield approximately 60 million USD in EBIT improvement in a modest growth environment for next year. The company maintains its earlier guidance for the Insulation business of significantly narrowing losses in 2012. The effects of higher volumes as a result of an improving U.S. housing market, as well as continued operating leverage in the business, continue to support this outlook. Preliminary third-quarter adjusted EBIT is 81 millionUSD. In the third quarter of 2012, the company had 22 million USD of certain items that were not the result of current operations. Before adjusting for these items, preliminary third-quarter EBIT is 59 million USD. In 2011, there were no adjusted items to reported EBIT. Additional information will be provided during the company’s third-quarter earnings call, which is scheduled to occur at 11 a.m. (ET) on Wednesday, Oct. 24, 2012.