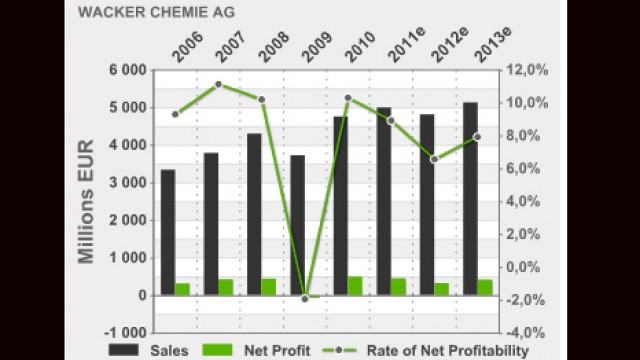

In fiscal 2011, according to preliminary figures, Munich-based chemical company Wacker Chemie AG continued to increase its sales compared to the prior year, achieving total sales of EUR 4.91 billion in 2011, up more than 3% year over year.

In fiscal 2011, Wacker Chemie AG continued to increase its sales compared to the prior year. According to preliminary calculations, the Munich-based chemical company achieved total sales of EUR 4.91 billion in 2011 (2010: EUR 4.75 billion), up more than 3% year over year. This slight sales rise stemmed mainly from volume gains, as well as higher prices for some products. In contrast, a weaker US dollar compared with 2010 slowed sales growth.

According to preliminary figures, earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to around EUR 1.10 billion (2010: EUR 1.19 billion), down some 8% year over year. Earnings before interest and taxes (EBIT) are estimated to reach about EUR 600 million in 2011 (2010: EUR 765 million) according to preliminary calculations. Impairments on fixed assets totalling some EUR 40 million had an impact here, of which around EUR 15 million are due to closure of the Group’s semiconductor plant in Hikari, Japan. Wacker Group’s net income for 2011 is expected to be some EUR 350 million (2010: EUR 497 million).

The main reason behind the earnings decline was weak Q4 2011 business, primarily in the semiconductor and solar industries. In the year-end quarter, EBITDA remained below the Q4 2010 level at all business divisions. Significantly higher year-over-year costs for raw materials and energy slowed the Group’s earnings trend. Price increases meant that Wacker spent around EUR 160 million more on raw materials and energy in 2011 than a year earlier.

“Our business developed well over the first nine months,” said CEO Rudolf Staudigl. “The decline in semiconductor and solar demand was stronger than we had expected and caused Q4 figures to come in below our estimate. Overall, we slightly increased our full-year sales with an operating result near the high prior-year level.”

Wacker’s investments amounted to some EUR 980 million in 2011 (2010: EUR 695 million) according to preliminary figures. Wacker financed these investments through cash flow from operating activities including advance payments by customers. In terms of net financial liabilities, Wacker posted a surplus of around EUR 100 million (2010: EUR 264 million) at the end of 2011.

Investment spending in 2011 focused on the Group’s strategic growth projects. These primarily include facilities for producing hyperpure polycrystalline silicon in Nünchritz and Charleston, Tennessee (US). At its Nünchritz site, Wacker started polysilicon production in October. Construction of the new production site in Charleston progressed well in 2011.

In Q4 2011, the Group’s business developed significantly weaker than in the preceding quarters. Demand for semiconductor wafers and solar-grade silicon, in particular, was at a low level, also due to customers reducing inventories. At the Group’s chemical divisions, the normal seasonal effects on business – particularly with the construction sector – had a stronger impact than a year earlier. In total, Group sales from October through December 2011 amounted to EUR 1.01 billion (Q4 2010: EUR 1.21 billion). This is 16% lower than in the comparable period a year ago. Against Q3 2011 (EUR 1.28 billion), sales dropped 21%. Wacker’s fourth quarter EBITDA reached some EUR 110 million (Q4 2010: EUR 292 million).

In the year-end quarter of 2011, several non-recurring effects influenced earnings in contrasting ways – reducing EBITDA by, on balance, some EUR 15 million. Due to the termination of supply contracts with customers exiting the solar business, Wacker Polysilicon retained advance payments and indemnity payments totalling around EUR 65 million. Over and above the standards specified in Germany’s so-called “Heubeck” tables, Wacker added a further amount of some EUR 30 million to its pension provisions to take account of the higher life expectancy of the Group’s pension-fund beneficiaries. Obligations for the closure of the wafer plant in Hikari, Japan – announced in early December – reduced Siltronic’s fourth-quarter EBITDA by some EUR 50 million.

The chemical divisions generated total sales in Q4 2011 of around EUR 605 million (Q4 2010: EUR 607 million), thereby nearly reaching the prior-year level. Chemical divisions’ EBITDA amounted to approximately EUR 25 million in Q4 2011 (Q4 2010: EUR 49 million), thus dropping by about half year over year. In addition to this winter season’s stronger decline in demand – e.g. for construction products – higher raw-material costs and lower prices for some silicone products also had an impact here.

The Group’s semiconductor business posted Q4 2011 sales and EBITDA that were significantly lower compared with both the prior-year and prior-quarter figures. In the fourth quarter of 2011, Siltronic generated total sales of around EUR 180 million – a drop of 33% from a year earlier (Q4 2010: EUR 270 million). Dampened expectations for electronics-sector demand and Siltronic customers’ reduction of inventories were the reasons behind markedly lower silicon-wafer sales volumes compared to both the prior-year quarter and the preceding quarter. Siltronic’s EBITDA from October through December 2011 amounted to roughly EUR -60 million (Q4 2010: EUR 37 million). Beside weak business in the final quarter, obligations of EUR 50 million for the announced closure of the site in Hikari, Japan, were a further key factor in this earnings decline. Adjusted for this non-recurring effect, Siltronic’s fourth-quarter EBITDA was EUR -10 million.

At Wacker Polysilicon, high customer inventory levels and the consolidation process in the solar industry clearly left their mark on fourth-quarter figures. The division reported total sales of some EUR 255 million in the three months to the end of December 2011 (Q4 2010: EUR 374 million) – a drop of just under 32%. In the same period, EBITDA fell approximately 22% to about EUR 165 million (Q4 2010: EUR 211 million). This includes retained advance payments and indemnity payments totalling EUR 65 million from the termination of supply contracts with customers exiting the solar business.

Customer demand rebounded in the first few weeks of 2012. Although prices for semiconductor wafers continued to decline, Wacker is currently experiencing sales-volume increases at its chemical divisions, as well as for semiconductor wafers and polysilicon compared to Q4 2011.

Wacker Chemie AG will publish its Q4 Report and Annual Report 2011 on 14 March 2012.