Net sales grew for fourth consecutive quarter; Company expects to achieve the lower end of full-year profitability outlook

Third-quarter 2018 Financial & Operating Highlights

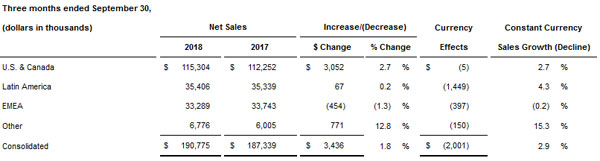

Net sales were 190.8 million USD, compared to 187.3 million USD in the prior-year period, a 1.8 percent increase (or an increase of 2.9 percent, excluding a 2.0 million USD currency impact).

Net loss was 5.0 million USD, compared to a net loss of 78.8 million USD in the third quarter of 2017. Included in third-quarter 2017 results was a 79.7 million USD non-cash goodwill impairment charge associated with the Latin America segment.

New products, defined as products introduced within the previous 36 months, contributed 15.9 million USD in sales, or 8.3 percent of total net sales, during the third quarter.

E-commerce sales were approximately 12.0 percent of total U.S. & Canada retail sales, an increase of 46.4 percent compared to the third quarter of 2017.

Adjusted EBITDA (see Table 1, available here) was 16.1 million USD, compared to 20.0 million USD in the third quarter of 2017.

“We were pleased to see many of the positive trends we observed across our business during the first half of the year continue during the third quarter, and we were able to deliver a fourth consecutive quarter of year-over-year net sales growth,” said Chief Executive Officer William Foley. “Our efforts to improve product margins remain on track, driven by our new products and e-commerce initiatives along with favourable price and mix. We also believe price competition across the industry remains in balance, and we’re maintaining our track record of outperforming foodservice industry sales growth, which gives us confidence that our market share is increasing.”

Foley continued, “Our performance in the back half of this year has been impacted by increased storage costs associated with higher inventory, increased utility costs and production downtime to reduce inventory. We have actions in place to lower costs and our inventory levels while ensuring our best-in-class service for customers. In addition, currency translation, most notably in Latin America, had a significant impact on third-quarter results compared to our prior year. Despite these short-term impacts, we’re entering the upcoming holiday selling season with great momentum behind our products in the marketplace, and we expect to enter fiscal year 2019 well positioned to stay on track with our long-term financial goals.”

Net sales in the U.S. & Canada segment increased 2.7 percent, driven by favourable price and product mix sold in the foodservice and business-to-business channels, as well as improved channel mix and volume in the segment.

In Latin America, net sales increased 0.2 percent (an increase of 4.3 percent excluding currency fluctuation) as a result of higher volume and favourable pricing, offset primarily by unfavourable currency impacts.

Net sales in the EMEA segment decreased 1.3 percent driven primarily by lower volume. Partially offsetting the decrease was favourable price and product mix on product sold across all channels, as well as favourable channel mix.

Net sales in Other increased 12.8 percent as a result of higher sales volume and favourable price and mix in China.

The Company’s effective tax rate was (54.9) percent for the third quarter of 2018, compared to (3.6) percent in the prior-year quarter. The change in the effective tax rate was driven by differing levels of pre-tax income, significantly higher non-deductible expenses in the prior-year quarter including a 79.7 million USD impairment of goodwill in our Mexico reporting unit, and the timing and mix of pre-tax income earned in tax jurisdictions with varying tax rates differing from that forecasted for the full year.

First Nine Months of 2018 Financial & Operating Highlights

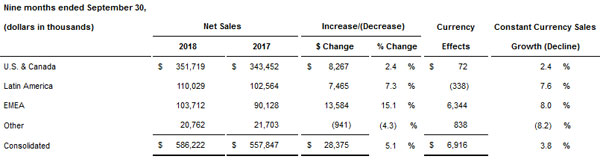

Net sales in the U.S. & Canada segment increased 2.4 percent, driven by favourable price and product mix sold, as well as higher volume, partially offset by unfavourable channel mix.

In Latin America, net sales increased 7.3 percent (an increase of 7.6 percent excluding currency fluctuation) as a result of higher volume and favourable pricing. Partially offsetting the increase is unfavourable product mix in the retail channel.

Net sales in the EMEA segment increased 15.1 percent and were favourably impacted by 6.3 million USD of currency. Also leading to the year-over-year improvement is favourable price and product mix on product sold in all three channels as well as higher sales volume in those channels.

Net sales in Other were down primarily as a result of lower sales volume in China, partially offset by favourable price and product mix and favourable currency impacts.

The Company’s effective tax rate was 314.3 percent for the first nine months of 2018, compared to (2.0) percent in the year-ago period. The change in the effective tax rate was driven by differing levels of pre-tax income, significantly higher non-deductible expenses in the prior year (including a 79.7 million USD impairment of goodwill in our Mexico reporting unit) and the timing and mix of pre-tax income earned in tax jurisdictions with varying tax rates differing from that forecasted for the full year. Cash taxes paid for the first nine months of 2018 and 2017 were approximately 7.2 million USD and 2.6 million USD, respectively, with the increase principally attributable to higher pre-tax income in Mexico.

Balance Sheet and Liquidity

The Company had remaining available capacity of 59.6 million USD under its ABL credit facility at September 30, 2018, with 32.0 million USD in loans outstanding and cash on hand of 19.1 million USD.

At September 30, 2018, Trade Working Capital (see Table 3, available here [paste link into “available here”: https://investor.libbey.com/news-and-events/news/news-details/2018/Libbey-Inc-Announces-Third-Quarter-Results/default.aspx]), defined as inventories and accounts receivable less accounts payable, was 228.7 million USD, an increase of 13.1 million USD from 215.6 million USD at September 30, 2017. The increase was a result of higher inventories, higher accounts receivable and lower accounts payable.

Outlook

The Company has affirmed its previously provided full-year 2018 sales outlook and expects to achieve the lower end of its full-year profitability outlook. As of the date of this news release, the Company now expects:

Net sales increase in the low-single digits, compared to full-year 2017 sales, on a reported basis;

Adjusted EBITDA margins (see Table 6, available here) at the lower end of the previously communicated 10 percent to 11 percent range;

Capital expenditures near 50 million USD, which is at the low end of the previously estimated 50 million USD to 55 million USD range; and

Adjusted selling, general and administrative expense in the range of 15.5 percent to 16.0 percent of net sales.

Jim Burmeister, senior vice president, chief financial officer, commented, “Cost controls implemented across the business have enabled us to improve our full-year outlook for selling, general, and administrative expenses as a percent of net sales for the second consecutive quarter. These improvements will offset the higher operating costs previously mentioned and improve financial performance in the fourth quarter. We also expect capital spending to come in at the low end of our previously communicated range which will help offset higher inventory. In addition to our focus on improving operating performance, we remain committed to pursuing a capital allocation strategy that assigns greater priority to debt reduction while maintaining appropriate levels of investment in strategic initiatives that are expected to enhance long-term value for shareholders.”

About Libbey Inc.

Based in Toledo, Ohio, Libbey Inc. is one of the largest glass tableware manufacturers in the world. Libbey Inc. operates manufacturing plants in the U.S., Mexico, China, Portugal and the Netherlands. In existence since 1818, the Company supplies table top products to retail, foodservice and business-to-business customers in over 100 countries. Libbey’s global brand portfolio, in addition to its namesake brand, includes Libbey Signature®, Master’s Reserve®, Crisa®, Royal Leerdam®, World® Tableware, Syracuse® China, and Crisal Glass®. In 2017, Libbey Inc.’s net sales totalled 781.8 million USD. Additional information is available at www.libbey.com.