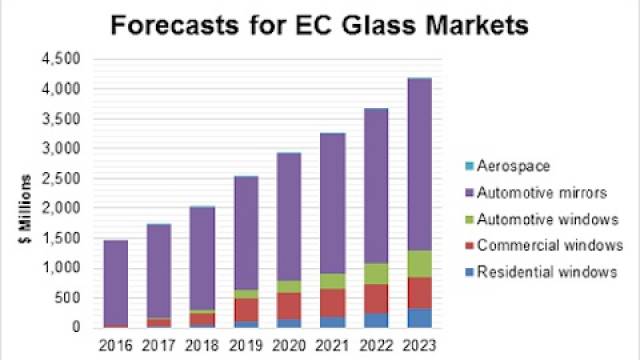

A new report from industry analyst firm n-tech Research indicates the market for electrochromic (EC) glass and film systems will approach $3.0 billion in revenue by 2020, and will continue to grow to nearly $4.2 billion by 2023.

Much of the revenue generation will come from the mature sector of self-dimming auto mirrors, but the real growth opportunities will be in smart windows for buildings and vehicles, as well as potentially new applications such as lenses for mobile devices.

This report updates n-tech’s evaluation of the electrochromic glass market, identifying and quantifying opportunities that have emerged and which we see emerging over the coming eight-year period. This includes granular eight-year forecasts in both volume and value terms.

The scope of the analysis, and to some extent the forecasts, also includes the electrode materials used for EC windows. It also covers substrate materials for smart windows, both plastic and glass, and discusses changing manufacturing patterns within the EC glass business, and why analysts continue to anticipate changes at the manufacturing level that eventually should prove critical to the commercial future of EC glass.

It examines the strategies of leading firms marketing EC glass and film, and shows how novel EC materials play into the total smart windows value chain. Companies discussed in this report include: Asahi Glass, Boeing, Chromogenics, Continental Automotive Systems, Corning, E-Chromic Technologies, EControl-Glas, Fuyao, Gentex, Gesimat, Guardian, HelioTrope Technologies, Magna International, Merck, Next Energy, NexTint, NSG/Pilkington, PPG, Sage Electrochromics, Saint-Gobain, SunPartner, Switch Materials, Tesla, and View.

Highlights from the Report include:

• n-tech continues to see the brightest future for EC technology in smart windows. This sector is still relatively tiny today, but is forecast to grow substantially over the next several years. Smart windows in buildings surging from barely $40 million today to nearly $500 million by 2019. Automotive smart windows will come along more slowly but we see this sector approaching $500 million as well, by the end of our eight-year forecast period. More novel applications are still being evaluated, such as for camera assemblies in mobile devices, where potential addressable markets could be massive with billions of annual shipments.

• Customers evaluating smart windows have become more receptive over the past year or two to understanding a broader cost-comparison of not just glass but at avoided up-front costs, such as shading systems, interior lighting, and downsized HVAC investments. Compared on that level, EC firms say they are now matching or even winning the business case.

• Another message that is resonating with EC glass customers, especially for owner-occupied buildings, is connecting the dots between daylighting, more comfortable interior working spaces, and occupant productivity. Overstock.com, which will have 40,000 ft2 of EC glass in its new headquarters in Salt Lake City, calculates every 1 percent more productivity for its $100 million payroll is worth $1 million.

• ROI of the glass itself is still something of a touchy subject; costs are still far higher for EC (for example 2x vs. low-end static glass). Nevertheless, there are incremental improvements here as companies get more comfortable with and keep scaling up their production efforts. At the same time, n-tech considers newer manufacturing and technology approaches will be needed for major cost improvements; these would include wet processing and printing, and more use of EC on plastic films.

• Projects in the pipeline are growing not just in number (Sage and View have doubled their pipelines in the past year), but in size and scope as well. Many are now in the tens of thousands of ft2, instead of measured mostly in hundreds or a thousand ft2. This not only speaks to market success, but it helps de-risk the technology and provide reference points for many new customers evaluating dynamic glass.

• “On the technology front, we’re not seeing or hearing of any real game-changing updates to change our previous thinking about where they all stand relative to each other seeking market inroads. We continue to hear strong support for existing processes (sputtering and deposition) and commitment to achieving incremental improvements in productivity and cost. Nevertheless, we continue to believe that major improvements in both areas eventually will usher in newer and simpler lower-cost options: plastic or film substrates, and wet coating and even printing technologies,” said a company spokesperson.

Details of the new report are available at http://ntechresearch.com/market_reports/electrochromic-glass-and-film-markets-2016-2023