Glaston Corporation has published its Continuing Operations January-September 2012 compared with January–September 2011, expecting that the 2012 net sales of Continuing Operations will be on the level of 2011.

Continuing Operations January-September 2012 compared with January–September 2011

– Orders received totalled EUR 84.7 (85.6) million. Orders received in the third quarter were EUR 28.4 (21.8) million.

– The order book on 30 September 2012 was EUR 35.3 (34.5) million.

– Net sales were EUR 83.2 (85.9) million and third-quarter net sales were EUR 24.6 (22.2) million.

– EBITDA was EUR 0.2 (1.1) million, i.e. 0.2 (1.2)% of net sales.

– The operating result excluding non-recurring items was a loss of EUR 3.9 (3.2 loss) million, i.e. -4.6 (-3.7)% of net sales. The third-quarter operating result excluding non-recurring items was a loss of EUR 0.4 (2.3 loss) million.

– The operating result was a loss of EUR 6.9 (3.1 loss) million, i.e. -8.2 (-3.6)% of net sales. The third quarter operating result was a loss of EUR 0.4 (2.2 loss) million.

– Return on capital employed (ROCE) was -13.1 (-1.6)%.

– Earnings per share were EUR -0.16 (-0.13) and third-quarter earnings per share were EUR -0.07 (-0.04).

– The Software Solutions segment was transferred to Discontinued Operations after Glaston announced that it was negotiating the sale of the business area.

President & CEO Arto Metsänen: “After a challenging start of the year, markets showed signs of picking up in the third quarter of 2012. In the North American market, the cautiously positive development continued. In South America and the EMEA area, the market was stable. The market picked up in Asia.

In October we announced that we were negotiating the sale of the Software Solutions business area. The sale is expected to be completed by the end of the year. The sale will enable us to direct our strategic focus towards our core operations, namely on glass processing machines and related services. In these business areas we have outstanding know-how and the best opportunities to serve and support our customers.

The glass industry’s most important fair, glasstec, which took place at the end of October, exceeded our expectations in terms of activity. We launched a number of new products at the fair, for example the Glaston RC350™ flat tempering machine, equipped with the latest technology, and the Glaston Air™ solution for tempering 2mm glass. Glaston’s new tempering machines have been very well received in the market, and a number of preliminary agreements were made at the fair, particularly for the Glaston FC 500™ and the Glaston RC 200™ products.”

On 19 October 2012, Glaston revised its outlook for 2012. Glaston expects that the 2012 net sales of Continuing Operations will be on the level of 2011 (2011 Continuing Operations: EUR 119.6 million). Continuing Operations’ operating result excluding non-recurring items is expected to be a slight loss (in 2011 Continuing Operations’ operating result excluding non-recurring items was a loss of EUR 3.1 million). Glaston’s Continuing Operations comprises the Machines and Services business areas.

Market development during the third quarter of 2012 was largely in line with expectations. In North America, the market continued its gradual recovery. In South America and the EMEA area, market conditions remained relatively stable. After a quiet start to the year, demand in Asia picked up in the third quarter.

As Glaston will focus in future on the Machines and Services business areas, the company’s operations will be divided more evenly into the different geographical areas. The geographical division of Continuing Operations’ net sales is presented in more detail in the section Continuing Operations’ net sales and operating result.

In the third quarter, the development of the Machines segment’s market in North America was cautiously positive. In the EMEA area, the market remained relatively good but, due to the unstable economic outlook, customers’ decision-making times lengthened. In Asia, the market picked up in the third quarter.

The focus of product development was on tempering of thin (2mm) glass and improving end product’s optical quality. At the glasstec fair, the glass industry’s leading event, held in October, Glaston presented the GlastonAir™ air floatation technology for thin glass tempering. At the event, Glaston also announced a global cooperation agreement with the German company Arcon relating to the reduction of anisotropy, namely iridescence, in glass.

In the third quarter, among the products presented by the Pre-processing product line at the glasstec fair were the new UC 300 and UC 500 automatic cutting lines and the new GlasWash glass washing machine.

In January-September, the Machines segment’s net sales totalled EUR 62.0 (63.8) million. The operating result excluding non-recurring items was a loss of EUR 3.1 (3.4 loss) million.

In the third quarter, the Services segment’s market in North America developed positively, with demand being directed over the entire product range. In South America and in Asia, the third quarter was challenging. As the utilization rates of customers’ machines remained low, demand for both spare parts and modernization products was weak. In the EMEA area, the market was stable.

In the review period, the Services segment launched a number of new products, all connected with improving end product capability and increasing capacity. There has been an emphasis on the user-friendliness of products. At the glasstec fair, Glaston presented the RC200 zone™ upgrade product, which enables the modernization of old or damaged chambers of tempering machines. The company also launched a new control system upgrade, iControl™ (iC™), for Glaston’s flat tempering lines. iControl™ improves process management and increases productivity.

In the third quarter, a number of significant deals were concluded in the Middle East, Russia and North America. In the Pacific area, Glaston concluded its largest ever single deal of the Services segment, valued at around EUR 0.9 million.

The Services segment’s January-September net sales totalled EUR 22.3 (23.1) million and the operating result excluding non-recurring items was a profit of EUR 4.0 (4.7) million.

Glaston’s orders received in the review period totalled EUR 84.7 (85.6) million. Of orders received, the Machines segment accounted for 72% and the Services segment 28%. Orders received in the third quarter totalled EUR 28.4 (21.8) million, i.e. showing a 30% growth.

Glaston’s order book on 30 September 2012 was EUR 35.3 (34.5) million. Of the order book, the Machines segment accounted for EUR 31.3 million and the Services segment for EUR 4.0 million.

Glaston’s January-September net sales totalled EUR 83.2 (85.9) million. The Machines segment’s net sales in January-September were EUR 62.0 (63.8) million and the Services segment’s net sales were EUR 22.3 (23.1) million.

Third-quarter 2012 net sales totalled EUR 24.6 (22.2) million and were distributed across the business segments as follows: Machines EUR 18.4 (16.2) million and Services EUR 6.8 (6.3) million.

Geographically, net sales were divided as follows: EMEA 43%, Asia 23%, Americas 34%.

In January-September, the operating result excluding non-recurring items was a loss of EUR 3.9 (3.2 loss) million, i.e. -4.6 (-3.7)% of net sales. In January-September, the Machines segment’s operating result excluding non-recurring items was a loss of EUR 3.1 (3.4 loss) million and the Services segment’s operating result excluding non-recurring items was a profit of EUR 4.0 (4,7) million.

The third-quarter operating result excluding non-recurring items was a loss of EUR 0.4 (2.3 loss) million. The Machines segment’s operating result excluding non-recurring items was a loss of EUR 0.5 (1.7 loss) million and Services segment’s operating result excluding non-recurring items was a profit of EUR 1.3 (0.9) million.

Continuing Operations’ operating result was a loss of EUR 6.9 (3.1 loss) million. A goodwill impairment loss of EUR 3.0 million directed at the Pre-processing operating segment was recognized as a non-recurring item in the first quarter.

Continuing Operations’ result in January-September was a loss of EUR 11.9 (14.0 loss) million, and in the third quarter a loss of EUR 2.0 (4.3 loss) million. The result, after the result of Discontinued Operations, was a loss of EUR 17.1 (13.3 loss) million, and in the third quarter a loss of EUR 7.8 (4.6 loss) million. Discontinued Operations’ result includes a EUR 5.2 million goodwill impairment loss. Return on capital employed was -13.1 (-1.6)%.

Continuing Operations’ earnings per share were EUR -0,11 (-0.14), while Discontinued Operations’ earnings per share were -0.05 (+0.01) euros, i.e. a total of EUR -0.16 (-0.13). In July-September, Continuing Operations’ earnings per share were EUR -0.02 (-0.04), while Discontinued Operations’ earnings per share were EUR -0.06 (0.00), i.e. a total of EUR -0.07 (-0.04).

At the end of the review period, the consolidated asset total was EUR 163.4 (187.9) million. The equity attributable to owners of the parent was EUR 36.0 (54.0) million, i.e. EUR 0.34 (0.51) per share. The equity ratio on 30 September 2012 was 24.5 (31.5)%. The equity ratio on 31 December 2011 was 31.1%. Net gearing was 156.3 (101.4)% (on 31 December 2011: 93.5%).

Return on equity in January-September was -50.9 (-37.7)%.

Cash flow from operating activities, before the change in working capital, was EUR 0.1 (-8.6) million in the review period. The change in working capital was EUR -1.8 (+6.6) million. Cash flow from investments was EUR -4.3 (-3.9) million. Cash flow from financing activities in January-September was EUR -1.0 (+8.1) million.

The Group’s loan agreements contain covenant terms and other commitments that are linked to consolidated key figures. The covenants in use are EBITDA/net financial expenses (interest cover), net debt/EBITDA, cash and cash equivalents and gross capital expenditure. During the review period, Glaston renegotiated some of the loan covenants with lenders.

In the third quarter, adjustment measures were directed primarily at Italy, where temporary layoffs of personnel continued.

The gross capital expenditure of Glaston’s Continuing and Discontinued Operations totalled EUR 4.4 (4.1) million. In the review period, there were no significant individual investments; the biggest investments were capitalizations of product development expenditure.

In the review period, depreciation and amortization of Continuing Operations on property, plant and equipment, and on intangible assets totalled EUR 4.0 (4.1) million. A EUR 3.0 million goodwill impairment loss, directed at the Machines business area, was recognized in the first quarter.

Discontinued Operations consists of Glaston’s Software Solutions business area. On 19 October 2012, Glaston announced in a stock exchange release that it was entering into negotiations on the sale of the Software Solutions business area.

Discontinued Operations’ revenue in the review period totalled EUR 15.1 (17.5) million and the result before taxes was a loss of EUR 4.7 (1.0 profit) million. Discontinued Operations’ result includes a EUR 5.2 million goodwill impairment loss, which arose from the remeasurement of net assets held for sale at fair value less costs to sell.

In August, Glaston announced a change in its Executive Management Group. Sasu Koivumäki, Vice President Sales and Service in North America was appointed Chief Financial Officer as of 1 October 2012.

On 30 September 2012, Glaston’s Continuing Operations had a total of 624 (693) employees, of whom 25% worked in Finland and 25% elsewhere in Europe, 31% in Asia and 20% in the Americas. In the review period, the average number of employees was 638 (705). On 30 September 2012, the Software Solutions segment had a total of 186 (205) employees. In the review period, Continuing and Discontinued Operations had an average total of 830 (907) employees.

Glaston Corporation’s paid and registered share capital on 30 September 2012 was EUR 12.7 million and the number of issued and registered shares totalled 105,588,636. The company has one series of share. At the end of September, the company held 788,582 of the company’s own shares (treasury shares), corresponding to 0.75% of the total number of issued and registered shares and votes. The counter book value of treasury shares is EUR 94,819.

Every share that the company does not hold itself entitles its owner to one vote at the Annual General Meeting. The share has no nominal value. The counter book value of each registered share is EUR 0.12.

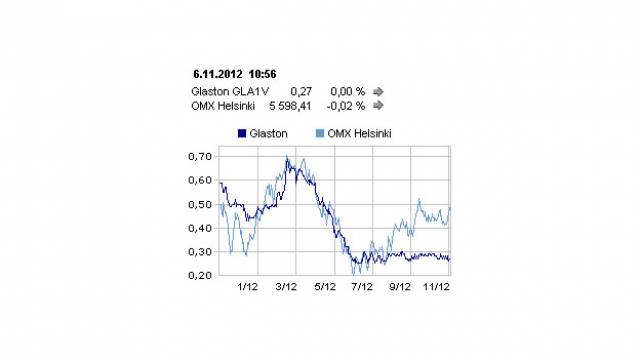

On 30 September 2012, the market capitalization of the company’s shares, treasury shares excluded, was EUR 29.3 (67.1) million. During the first nine months of the year, approximately 13.6 million of the company’s shares were traded, i.e. around 13% of the average number of shares. The lowest price paid for a share was EUR 0.24 and the highest price EUR 0.74. The volume-weighted average price of shares traded during January-September was EUR 0.43. The closing price on 30 September 2012 was EUR 0.28.

The equity per share attributable to owners of the parent was EUR 0.34 (0.51).

On 19 October 2012, Glaston announced in a stock exchange release that it was entering into negotiations on the sale of the Software Solutions business area. The sale is expected to be completed by the end of the year. As a result, the company revised its outlook. Glaston expects that the 2012 net sales of Continuing Operations will be on the level of 2011 (2011 Continuing Operations: EUR 119.6 million). Continuing Operations’ operating result excluding non-recurring items is expected to be a slight loss (in 2011 Continuing Operations’ operating result excluding non-recurring items was a loss of EUR 3.1 million). Glaston’s Continuing Operations comprises the Machines and Services business areas.

Glaston’s uncertainties and risks in the near future are to a large extent linked to the development of the world economy. Economic instability in Europe as well as slower growth in Asia will affect Glaston’s development. Slower economic growth may continue to result in the postponement of orders and changes in machine delivery schedules. Customers’ difficulties relating to finance arrangements may restrict their investment opportunities. These might be reflected in the development of the latter part of the year.

The underlying nature of the sector is expected to remain unchanged, so development in the coming years is expected to be positive. If the recovery of the sector is delayed or slows, this will have a negative effect on Glaston’s result. The shift of the geographical focus of business activity to areas of higher economic growth will, however, dampen the financial impact of a possibly slower recovery in Western Europe and North America, despite a levelling off of the Asian and South American markets.

Glaston performs annual goodwill impairment testing during the final quarter of the year. In addition, goodwill impairment testing is performed if there are indications of impairment. Due to prolonged market uncertainty, it is possible that Glaston’s recoverable amounts will be insufficient to cover the carrying amounts of assets, particularly goodwill. If this happens, it will be necessary to recognize an impairment loss, which, when implemented, will weaken the result and equity.

Glaston’s markets will continue to be challenging in the final quarter of 2012. Growth in the Asia market has levelled off. The North American market continues to show signs of recovery, and we believe this positive trend will continue. We expect stable development in the South Americas and EMEA area markets.

The cornerstones of Glaston’s operations remain the architectural glass segment and the solar energy market. The architectural glass segment creates the foundation for the company’s future growth. In the longer term, prospects for the solar energy segment are good. In these segments, Glaston is able to offer its customers a modern and competitive product range.

Glaston expects that the 2012 net sales of Continuing Operations will be on the level of 2011 (2011 Continuing Operations: EUR 119.6 million). Continuing Operations’ operating result excluding non-recurring items is expected to be a slight loss (in 2011 Continuing Operations’ operating result excluding non-recurring items was a loss of EUR 3.1 million). Glaston’s Continuing Operations comprises the Machines and Services business areas.”