O-I Glass, Inc. announced that it has fully allocated the net proceeds of the 500 million EUR 2.875 percent Senior Notes due 2025 issued by OI European Group B.V., a subsidiary of O-I (“OIEG”). In November of 2019, OIEG became the first packaging company to issue a Green Bond, committing to allocate an amount equal to the net proceeds from the offering to finance and/or refinance new and/or existing Eligible Green Projects within 36 months from the issue date of the Green Bond.

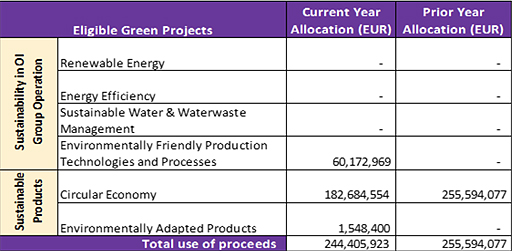

The allocation of the 500 million EUR was focused on improving the environmental footprint of O-I products and production through the purchase of recycled glass (cullet), investments in innovative, lower-emission production technologies such as MAGMA, as well as other capital projects aimed at reducing greenhouse gas emissions and improving the energy efficiency of our operations. Purchasing cullet to drive recycled content of glass packaging, for example, is a qualifying Eligible Green Project that supports the circular economy through increased demand for post-consumer recycled glass. Additional details of our allocation are provided in the table below:

“O-I is on a journey of leadership, bold action and transformational change to exceed the evolving requirements of the packaging market,” said Andres Lopez, Chief Executive Officer for O-I. “We are the market, innovation and ESG leader and have pioneered numerous sustainable firsts, such as issuing our Green Bond, as we strive to be the most innovative, sustainable and chosen supplier of brand-building packaging solutions.”

“O-I is on a journey of leadership, bold action and transformational change to exceed the evolving requirements of the packaging market,” said Andres Lopez, Chief Executive Officer for O-I. “We are the market, innovation and ESG leader and have pioneered numerous sustainable firsts, such as issuing our Green Bond, as we strive to be the most innovative, sustainable and chosen supplier of brand-building packaging solutions.”

Among its notable sustainable firsts, O-I was also the first glass packaging company to obtain an approved Science-Based Target initiative GHG emissions reduction goal in pursuit of a 2030 target to reduce GHG emissions by 25 percent. And, the company recently announced an expanded set of sustainability goals in its 2021 Sustainability Report, detailing a roadmap to a more sustainable future.

“The world wants both highly sustainable packaging and equally sustainable companies and manufacturing processes,” said Randy Burns, Chief Sustainability and Corporate Affairs Officer. “O-I is in a constant search for more balance among its operations and products and the needs of others, the planet and our collective prosperity, setting a roadmap for the sustainable we seek while making a difference today.”

The investment in cullet drives progress toward a sustainable future, while making an immediate impact by cutting carbon emissions, reducing energy, and conserving natural resources. Based on the volume of cullet allocated to the offering the company conserved approximately:

- 3.2 million metric tons of CO2;

- 389 million KwH of energy;

- 6.5 million tons of silica sand;

- 2.1 million tons of soda ash; and

- 1.1million tons of limestone

These sustainable savings are compounded by other sustainable investments by the company in 2020, including:

- LED lighting installed at seven North American plants, saving 8.5 million kWh of energy

- Installation of Continuous Emission Monitoring to measure emissions at three plants in Mexico

- Four U.S. plants implemented a used tier sheet supplier to increase recycled material usage and reduce emissions

- Targeted partnerships in Colombia to collect cullet in the region

- Solar panels for renewable energy sourcing at two plants in France

- Recycling cooling water at facilities in China, leveraging heat to offset use of Liquid Petroleum Gas

Management’s assertion on the allocation of net proceeds to qualifying Eligible Green Projects as well as the examination report of our independent accountants are available on the O-I website, along with information on O-I’s overall sustainability agenda.