Quanex has released fiscal 2012 first quarter results for the period ending 31 January 2012, with Financial Statistics as of 1 January 2012 including: book value per common share: USD 11.62; Total debt to capitalization: 0.4%; Return on invested capital: 1.7%; Actual number of common shares outstanding: 36,756,713.

Quanex Building Products Corporation, a leading manufacturer of engineered materials, components and systems serving domestic and international window and door OEMs through its Engineered Products and Aluminum Sheet Products groups, has released fiscal 2012 first quarter results for the period ending 31 January 2012.

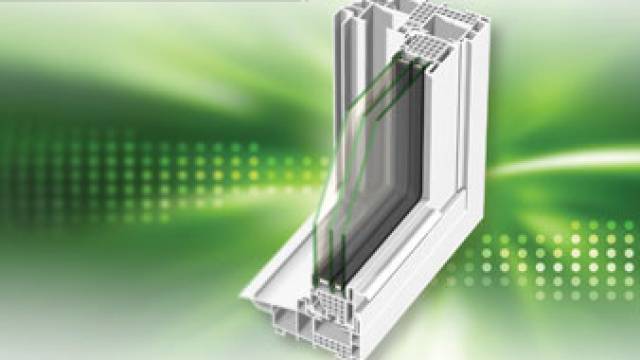

First quarter 2012 consolidated net sales were USD 161.6 million, compared to USD 159.8 million a year ago, and included Edgetech net sales of USD 18.9 million. First quarter 2012 operating loss was USD 0.18 per diluted share compared to an operating loss of USD 0.13 per diluted share a year ago. Engineered Products Group (EPG) is focused on providing window and door OEMs with fenestration components, products, and systems. Key end markets are residential repair & remodel (R&R) and new home construction.

EPG’s first quarter 2012 net sales were USD 99.4 million, compared to USD 84.0 million a year ago, and included net sales of USD 18.9 million at Edgetech. First quarter 2012 net sales, excluding Edgetech, were down about 4% from the year ago quarter which benefited from higher demand as a result of a USD 1,500 energy efficient window tax credit program that expired on 31 December 2010. EPG’s first quarter 2012 operating income was USD 1.8 million, compared to an operating loss of USD 0.7 million a year ago, and included an operating loss of USD 1.1 million at Edgetech. Segment expenses associated with the IG spacer consolidation programme were USD 2.5 million in the quarter, of which USD 0.4 million were included in Edgetech’s operating loss. First quarter 2011 operating loss of USD 0.7 million included USD 5.2 million of consolidation and warranty reserve costs.

At EPG, sales excluding Edgetech for the 12 months ended 31 January 2012, were down 2% from the previous 12 months, compared to US window shipments as reported by Ducker Worldwide that were down 7% over the same periods. The integration of Edgetech into the Engineered Products’ sales and marketing organization was completed in September 2011 and it is clear that Quanex is a stronger customer-focused company with the addition of Edgetech. While still early, the company believes the consolidated organization will continue to generate incremental opportunities.

On 7 November 2011, the company announced a consolidation program for its IG spacer manufacturing facility in Barbourville, KY into its IG spacer manufacturing facility in Cambridge, OH. At the completion of the consolidation, which is expected to be around August 2012, the Barbourville facility will be permanently closed. The consolidation remains on budget and on schedule. Cash costs associated with the plan have been estimated at about USD 16 million (excludes a pre-tax, non-cash impairment charge of USD 1.6 million taken in the fourth quarter 2011). The company expects a payback period on its investment of about 2.6 years, based on annual pre-tax cash savings of USD 9 million, once the consolidation is concluded.

Aluminum Sheet Products Group is a leading provider of aluminium sheet through its Nichols Aluminum operation. Key end markets are residential repair & remodel (R&R) and new home construction.

Nichols’ first quarter 2012 shipments, net sales and operating loss were 44 million pounds, USD 65.7 million and USD 5.5 million, respectively. Shipments were down from the year ago quarter in part due to weaker demand because of the absence of the window tax credit programme in the first quarter of 2012 compared to the available programme in the year ago quarter.

The operating loss of USD 5.5 million reflected the weaker end market demand and a reduced spread (sales less material costs) compared to the year ago quarter. London Metal Exchange aluminium prices fell through the quarter, which in turn, lowered the spread. Spread was down 6% from the year ago quarter and down 6% from the sequential fourth quarter, primarily due to the average selling price that fell faster than the average material costs. Nichols is a high fixed cost business, so as its shipments drop, its ability to substantially reduce operating costs is limited.

On 20 January 2012, Nichols experienced a strike with its union employees at two of its facilities. Negotiations for a new contract are ongoing, and management, along with temporary workers, is operating the two facilities while continuing to meet ongoing customer needs. The strike had no material financial impact on first quarter results.

For the 12 months ended 31 January 2012, Nichols’ shipments were down 14% from a year ago, versus industry shipments as reported by the Aluminum Association that were up 2%. Nichols underperformance is attributed to weaker residential demand, where it has a large presence, compared to stronger distribution and transportation demand, where it has a smaller presence.

Corporate expenses in the first quarter were USD 7.6 million and included ERP expenses of USD 0.7 million.

At quarter end, Quanex had a cash balance of USD 81.7 million, a total debt outstanding balance of USD 1.6 million, and cash provided by operating activities from continuing operations of USD 2.1 million. The company had no borrowings under its USD 270 million revolving credit facility at quarter end, however, due to the facility’s EBITDA covenant requirement, the available capacity was approximately USD 173 million at the end of the quarter. Future uses of cash could be to fund organic growth activities, fund cash dividends on the company’s common stock, make acquisitions, and repurchase outstanding shares. During the first quarter, the company purchased approximately USD 1.3 million of its outstanding common stock (94,337 shares of common stock at an average price of USD 13.61, including commissions).

Stagnant residential R&R demand, historically low home starts, elevated residential foreclosures, and stringent credit conditions will create a difficult housing environment in 2012. The company currently expects calendar year 2012 U.S. window shipments to be about 39 million units, which is 8% below Ducker’s forecasted shipments of 42.6 million. Quanex, however, remains positive on the long-term prospects of its residential and commercial markets and will continue to invest in its future. To that end, the company expects to continue to invest in growth, through both internal programs and acquisitions, as it believes this is the best way to maximize long-term returns for shareholders. For 2012, the company estimated capital expenditures of USD 49 million (includes IG consolidation capital of USD 7 million and ERP capital of USD 13 million), corporate expenses of USD 31 million (includes ERP costs of USD 3 million), and depreciation & amortization of USD 41 million (includes ERP depreciation of USD 3 million).

As previously announced on 23 February 2012, the Board of Directors declared a quarterly cash dividend of USD 0.04 per share on the company’s common stock, payable 30 March 2012, to shareholders of record on 15 March 2012.

Financial Statistics as of 1 January 2012 include: book value per common share: USD 11.62; Total debt to capitalization: 0.4%; Return on invested capital: 1.7%; Actual number of common shares outstanding: 36,756,713.